How to Generate Yield Using the Jones DAO Multiple-Layer LP Model

"This guide will explain how to combine jAssets with JONES LP farms to maximize your yield and stay comfy."

This guide assumes that your assets are already on Arbitrum. If you’re not familiar with this process, be sure to check out this resource on bridging to Arbitrum. Help is always available in our Discord if you have additional questions.

Introduction

Jones DAO provides users the opportunity to earn multiple layers of yield on their assets of choice. By using the combined power of jAssets, SLPs, and JONES farming, depositors can unlock a risk and yield profile unique to Jones DAO and to their personal preference. This guide will explain how to combine jAssets with JONES LP farms to maximize your yield and stay comfy.

Why Provide Liquidity with your jAssets?

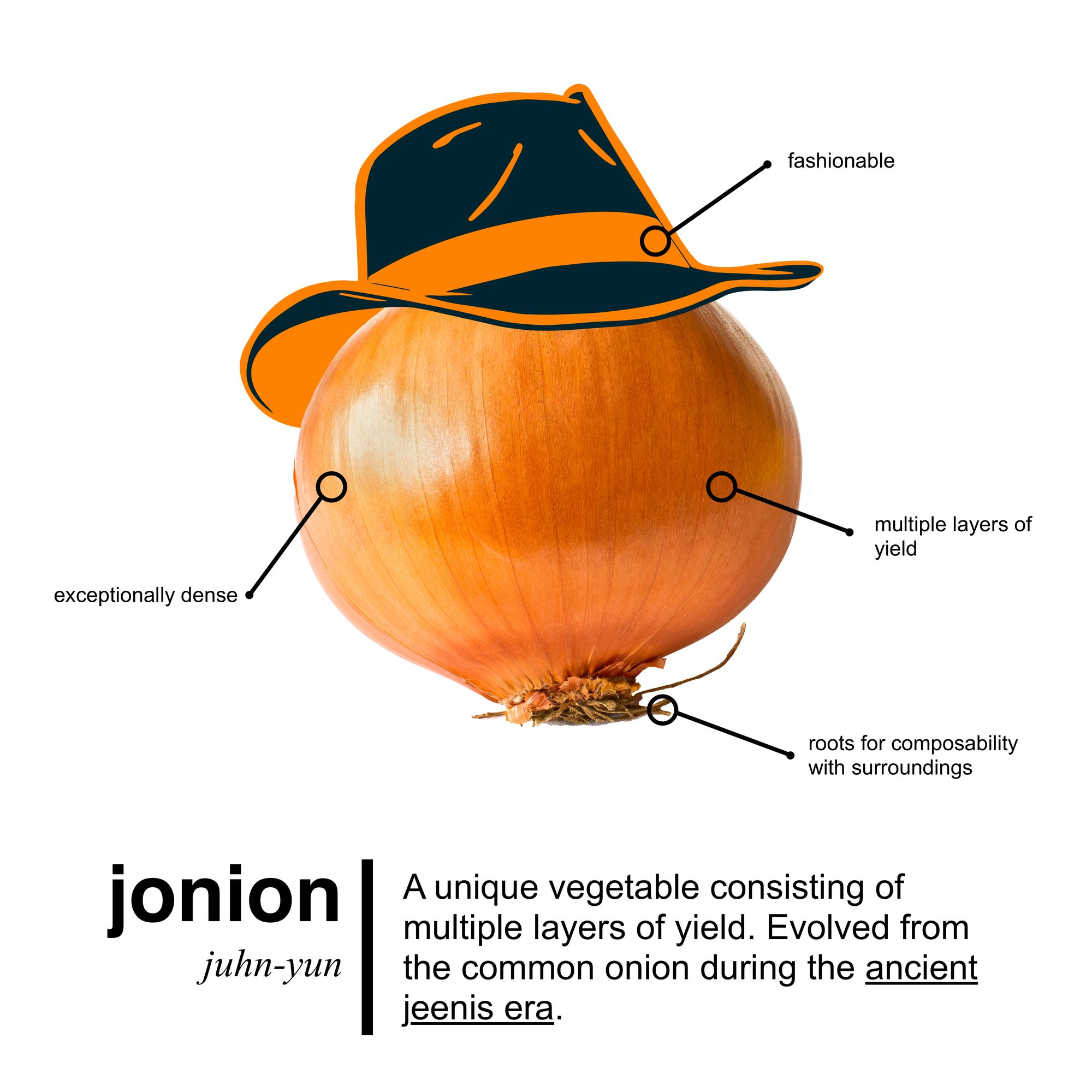

Jones DAO is designed to provide as many layers of yield as possible to our depositors - hence, the jonion. Embracing the multiple layers that Jones DAO offers is a key best practice that all of our strategists recommend.

Why is this the optimal route?

- Enjoy one-click organic yield on your jAssets

- Earn attractive $JONES rewards using the farming/LP technique explained in this guide

- Stake your LP $JONES rewards in our single-sided farm to earn even more $JONES

- Go even further with your jAssets in partner lending and collateralization protocols (coming soon)

Using the above strategies will give you access to healthy, risk-mitigated yield using novel DeFi strategies. Be sure to reach out in our Discord if you have any questions about our yield layers, LP positions, or the jonion.

The Strategy

Fully utilizing the Jones DAO vaults and LP farms is easy and can be used for any of our supported assets. For this guide, we’ll use gOHM as an example. This approach maximizes yield by giving users a base-level jAsset yield (via our options strategies) as well as additional JONES token incentives for providing liquidity to our asset pairs.

Step 1: Acquiring jAssets

To get started, head to our vaults page with your asset of choice ready to deploy in your wallet. Select your vault of choice and depending available room in the vault, you may deposit your desired amount into the vault via the deposit section on the right:

In this case, a user looking to deposit gOHM would receive jgOHM in return. jgOHM generates its base yield by using Jones DAO’s unique strategies. jgOHM is unique relative to jETH and jDPX given that the underlying gOHM quantity also continues to accrue the Olympus rebase APY.

Step 2: Preparing to Farm

Our JONES farms, which are available here, incentivize users to provide liquidity across all of our jAsset pairs. Liquidity is needed to ensure that jAssets are always tradeable for standard base assets (ex. jETH to ETH).

These farms work by incentivizing the deposit of SushiSwap SLPs. SLPs represent a liquidity deposit on the SushiSwap AMM which is the exchange of choice for jAssets (as well as many other Arbitrum-native assets). These liquidity deposits take the form of 50/50 asset pairs. This means that each SLP represents the deposit of equal amounts of two different assets.

In the interface above, a number of LPs are shown. In the case of jgOHM-gOHM LP, each LP token represents the pairing of 1 jgOHM and 1 normal gOHM token. This 50/50 split is designed to maximize liquidity for trading between the two assets at any given time. Given the 50/50 split, users need to have equal amounts of a given jAsset and base asset to enter an LP farm. A rule of thumb for easy farm participation is to only deposit half of your desired token in the Jones vault.

Adding liquidity is easy and can be done quickly via the Add Liquidity interface on Sushiswap. Before adding liquidity, make sure you’re on Arbitrum by using the network selection prompt located in the top right of the Sushi interface.

To add liquidity to jAsset pairs, you’ll need to import the jAsset tokens first. First, choose your base asset. To continue from the previous example, we’ll select gOHM:

Next, we’ll select the bottom input field to select the second token in our liquidity pair, which in this case would be jgOHM (the other half of the 50/50 pair).

Note: Jones DAO gained official support from Sushi in early April 2022. When adding jAssets, they should show up when you search for your tokens. Occasionally, the Sushi UI does not return these search results. In the case that this happens, the steps below will allow you to manually add jAssets.

After clicking input for the second token select “Manage Token Lists” at the bottom of the dialogue window that appears. Once you do this, you will be able to select the “Tokens” tab at the top of the interface:

To import jgOHM, we need to add the token via its own contract address. Our documentation includes the contract addresses of all jAssets available on the Jones DAO platform. These addresses are also listed below and will be updated as new jAsset vaults go live.

To input jgOHM, simply copy and paste the jgOHM token address from the above table into the token import field (which starts with 0x in the above screenshot). You should now see jgOHM as a token option:

Once jgOHM is recognized, click the token and then select import on the following prompt:

Now that you’ve imported jgOHM as an asset you’ve completed the hardest part. We’ll now deposit an equal amount of gOHM and jgOHM to receive our LP tokens (SLP). Select the amount of gOHM/jgOHM you’d like to deposit. Remember, you must have an equal amount of both the jAsset and base asset to deposit into the 50/50 SLP.

You’ll need to approve and deposit both gOHM and jgOHM, so there are a few transactions to complete here. Once you complete this process you will have a corresponding Sushi SLP for the 50/50 pool of your choice in your wallet.

Step 3: Farming

Now that you have your jAsset/Asset SLP it’s time to start earning JONES rewards. Head to our Farms page and select your LP of choice. You will now be able to stake your jAsset/Asset SLP to earn JONES rewards. Rewards accrue automatically in the Farms interface and can be claimed at any time.

Step 4: Get Comfy

That’s it! You are now earning multiple streams of yield on your assets. In the case of gOHM, which compounds via the Olympus rebase APY, depositors are generating three streams of yield - Olympus APY, Jones DAO vault yield, and jAsset/Asset LP yield. You can take it a step further and stake your claimed JONES rewards as you farm. This farm is single-sided and only involves staking standard JONES tokens, no SLPs required.

Conclusion

Users can generate impressive yields even during volatile market conditions by layering jAsset and LP yields together. For the Ohmies among us, it’s hard to beat a three-fold yield opportunity on gOHM anywhere else in DeFi. Time to stake and stay comfy.

Join the Jones DAO community now to stay up to date on our upcoming releases and partnership announcements. We’ll be hosting AMAs, previews, and sharing plenty of alpha: